This is the detailed guide for picking the best cloud based accounting software for your business.

I created it from real-world experience and extensive reviews of the top accounting software packages available at the moment. For this reason, my recommendations are informed and logical with specific advice on what to do that you can rely on.

In other words, this post differentiates the best of the best so you can make the right decision for your needs.

So, if you want to:

- Read in-depth reviews of the best small business accounting software;

- Understand their differences and suitability;

- Learn more about online accounting software;

Then, you’ll love the super-detailed information in this post.

Let’s get into it.

The Best Online Accounting Software of 2021

- Reviews

- What is Cloud Based Accounting Software?

- What are the main features of accounting software?

- FAQs

Disclosure: This site is a free resource that is supported entirely by its visitors. If you purchase a product or service here a referral fee may be received. This comes at no extra cost to you and helps create lots more useful content. Thank you.

1. Reviews

Here you’ll find a deep investigation of the best online accounting software which highlights their key differences to help you make the right decision.

~

QuickBooks – The #1 Choice

Best for Starting Out, Customer Support & Overall Value

Free Trial – $25 per month

QuickBooks was first developed by its parent company, Intuit, in the mid-1980s, and later launched their online accounting software in 2001. By 2014 QuickBooks Online (QBO) reported 600,000 users.

Nowadays, the QuickBooks online accounting platform caters for 2.2 million users. In short, its a brilliantly well-rounded platform that anyone can pick up and use effectively.

The main reason behind this is simple: QuickBooks listens to customers intently and develops its product accordingly.

The result is cloud based accounting software that’s specifically designed for different business types, including:

- Professional Services

- Retail

- Restaurants

- Construction

- Legal

- Manufacturing & Wholesale

- Churches

- Non-profit

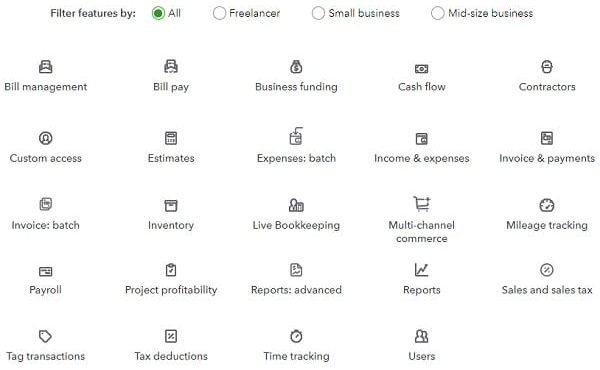

Moreover, QuickBooks offers a full suite of accounting features and functions for small to mid-size businesses.

Features

Additionally, they now offer ‘live bookkeeping’ which is exactly as the name suggests. Basically, you can hire a QuickBooks-certified virtual expert to set up & maintain your books with guaranteed accuracy!

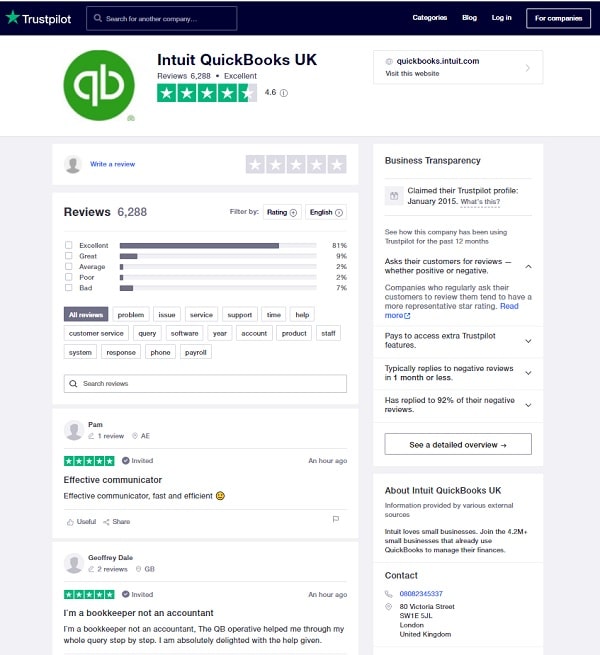

The real jewel in the crown, however, is their exceptional customer service which is critical to any business’s success, especially when starting out.

Simply put, QuickBooks customer support is fantastic in so much as they’re dedicated, genuine and the best in the industry by a long way. But, don’t just take my word for it…

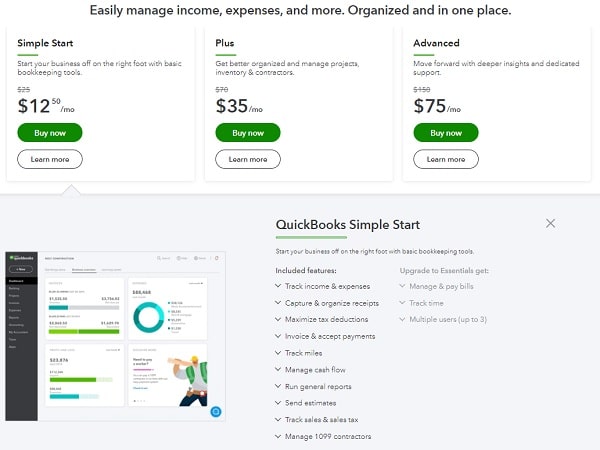

Pricing

The best plan for getting started is ‘Simple Start’ because it provides all the basic tools required for bookkeeping. When you’re ready it’s a few clicks to upgrade to more powerful packages and functionality.

QuickBooks offer a 30 day free trial with the following pricing options:

- Simple Start – $25 per month

- Plus – $70 per month

- Advanced – $150 per month

Or, you can get 50% off with an initial purchase of 3 months:

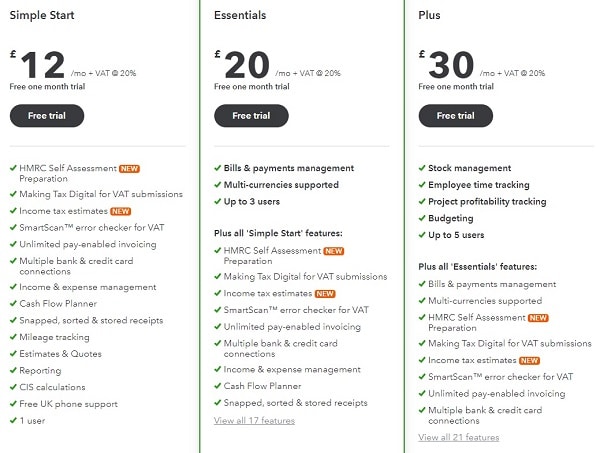

Pricing in the UK:

QuickBooks integrates beautifully with HMRC – at this price point, there is no better cloud accounting software in the UK.

Streamline your workflow, save valuable time and make more money – get a free trial here:

~

FreshBooks

Free Trial – $15 per month

FreshBooks is popular cloud based accounting software designed specifically for sole proprietors and self employed professionals. Since being founded in 2003, over 24 million people have used the platform and is used in over 160 countries.

Their philosophy is the 4 Es: Execute Extraordinary Experiences Everyday.

With this in mind, they’ve developed a simplistic interface that allows for easy maintenance of your books. Moreover, the platform has a decent mobile app (Android & iOS), and, being cloud based, is accessible from any computer with an internet connection.

Features

- Automatically track expenses

- Automatically send late payment reminders and bill late fees

- Send unlimited estimates and proposals

- Get paid with credit cards and bank transfers

- Get paid with checkout links

- Set up recurring billing and client retainers

- Track Bills, Bill Payments & Vendors with Accounts Payable

- Run business health reports

- Run financial and accounting reports

- Invite your accountant

- Access anywhere on iOS and Android

- Mobile mileage tracking

If you need more power, the system integrates with many other services, such as PayPal, MailChimp, Basecamp, WordPress, Gusto, and Zendesk.

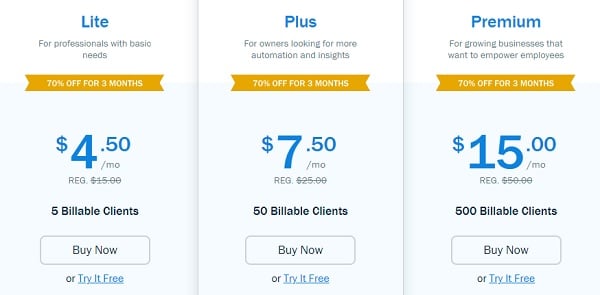

Pricing

The Lite plan is $15 per month and includes invoices, estimates, time tracking, expenses, take credit card payments and import expenses from a business bank account.

The Plus plan is $25 per month, allows for up to 50 clients, and includes sending proposals, recurring invoices and automatic expense tracking.

The $50 a month Premium plan increases the client limit to 500, and includes automatic payment reminders, bills tracking, and financial reporting.

- Lite – $15 (£11) per month

- Plus – $25 (£19) per month

- Premium – $50 (£30) per month

Or, you can get 70% off with an initial purchase of 3 months:

You can try FreshBooks on a 30 day free trial here:

~

Xero

Free Trial – $11 per month

Xero is a more recent addition to the cloud accounting software sector and is aimed at smaller businesses and sole traders. That said, their pricing also attracts start ups.

Since being founded in 2006, their platform has grown to 2 million subscribers and employs over 3,000 people. Moreover, their aim is to provide everything you need to run your business in a beautiful all-in-one online platform.

The user experience is very slick and easy to pick up, with an ‘undo’ button for pretty much everything. What’s more, the feature set is solid and comprehensive with the ability to ‘add on’ specific functionality if neccessary.

Features

- Send invoices

- Pay bills

- Claim expenses

- Bank connections

- Accept payments

- Track projects

- Bank reconciliation

- Contacts and ‘Smartlists’

- Reporting

- Inventory

- Purchase orders

- Multi-currency accounting

- Taxes and quoting

Payroll is an ‘add on’ that enables you to pay yourself and employees whilst covering all the tax implications as relevant.

It’s a powerful feature which, in the US, integrates with Gusto seamlessly for all tax considerations. In the UK, it’s a similar set up and can post the relevant taxes directly to HMRC (not to mention VAT if you add that on too).

Other apps can be connected also, such as Stripe, PayPal, GoCardless, Hubspot, MailChimp and some of the HR packages.

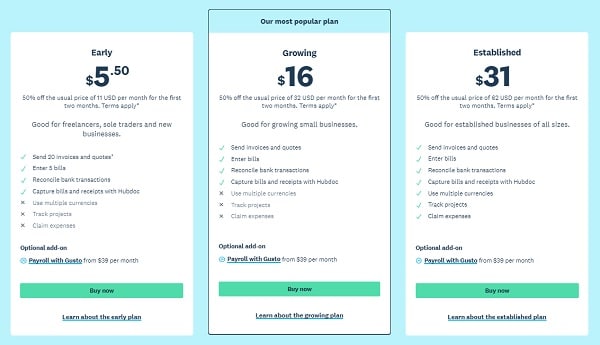

Pricing

Pricing focuses on providing the essentials for start ups and upgrades for more powerful functionality.

- Early – $11 (£8) per month

- GrowBig – $32 (£24) per month

- Established – $62 (£45) per month

Or, you can get 50% off with an initial purchase of 2 months:

You can try Xero on a 30 day free trial here:

~

Sage Business Cloud Accounting

Free Trial – $10 per month

Sage Accounting makes automating your small business finances easy with features like expense and payment tracking, invoicing, and remote access. It’s easy to use and setup to immediately save time, improve cash flow, and get you paid faster.

With cash flow management you can see how much money is coming in and out of your business each month. By tracking your invoices, you can get paid on time and protect your cash flow.

The user experience is modern and straight forward with a solid feature set that can grow with your business.

Features

- Create and send invoices

- Track what you’re owed

- Automatic bank reconciliation

- Supports unlimited users

- Send quotes and estimates

- Forecast cash flow

- Manage purchase invoices

- Snap receipts with AutoEntry

Sage also offers 24/7 customer support via online chat and free training, as well as live Q&A with a Sage Success Coach. You can even schedule a 1:1 with a Sage Accounting expert if you’re particularly concerned about getting set up correctly.

Much like other cloud based accounting software platforms, Sage integrates with Stripe so you can receive your money faster. There are other business tools to connect also including CRMs, compliance and credit control.

Pricing

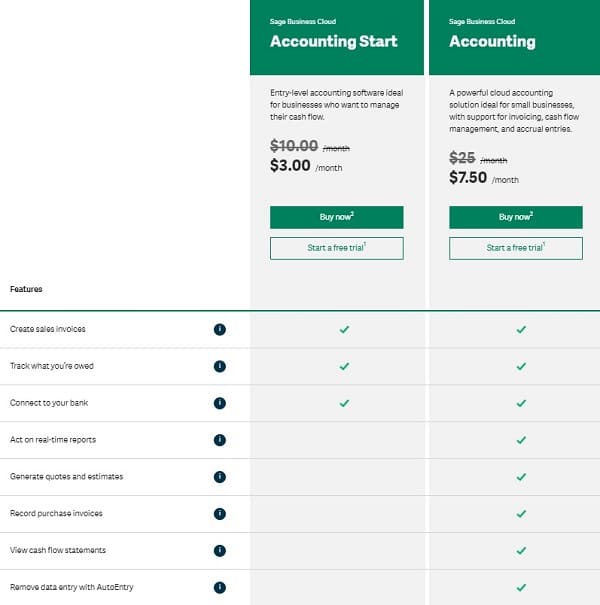

Sage Cloud Accounting offers a 1 month free trial, which then leads to tiered pricing based on your needs.

- Start – $10 (£7.50) per month

- Accounting – $25 (£18.50) per month

Or, you can get 70% off with an initial purchase of 3 months:

Try out Sage Cloud Accounting software here:

~

Zoho Books – cloud based accounting software

Free Trial – $9 per month

Zoho Books is online accounting software that manages your finances, automates business workflows, and helps you work collectively across departments

With its clean and simple user interface Zoho online accounting software is aimed at freelancers, sole traders or smaller businesses.

From raising purchase and sales orders to invoicing and claiming expenses, it makes small business accounting fast and easy.

Features

- Invoicing

- Expenses

- Estimates

- Bills

- Banking

- Inventory

- Sales Orders

- Purchase Orders

- Tax

- Online Payments

- Reporting

- Automation & Document Store

- Client Portal

Additionally, you can manage your finances wherever you go with their mobile app on either an Android or iOS device. What’s more, they offer phone and email support alongside a number of free guides, tutorials and forums if you have any issues.

Lastly, there are numerous out of the box integrations to boost productivity as your business grows, such as G Suite, Office and Zapier.

Pricing

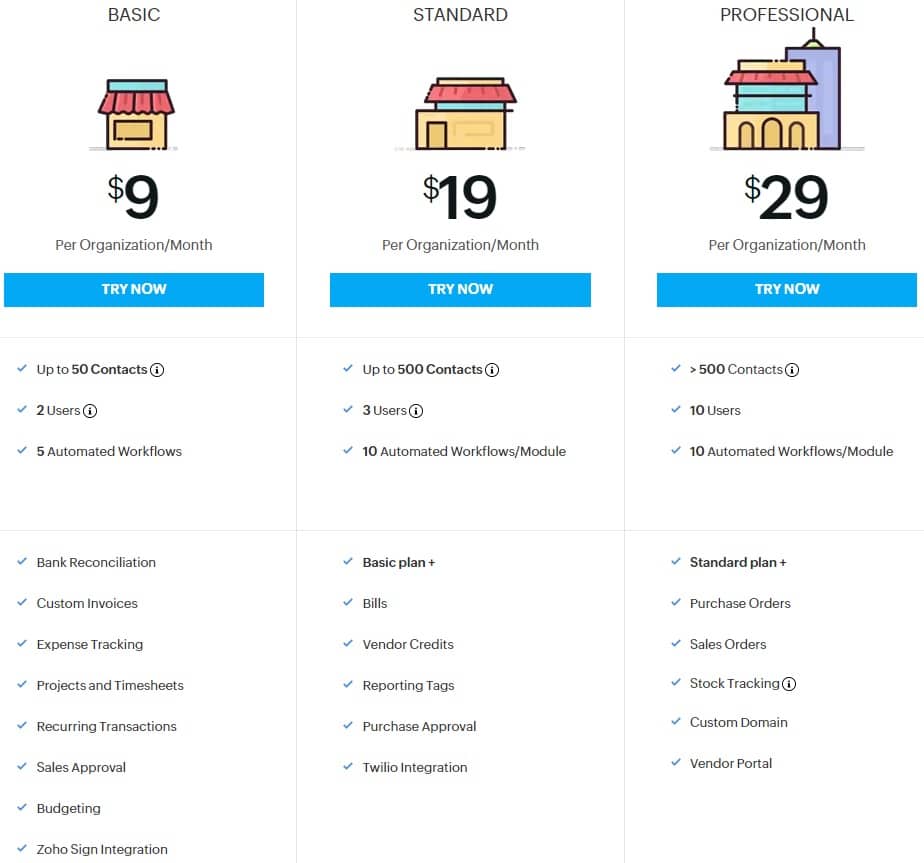

Zoho cloud accounting software offers a 14 day free trial, which then leads to tiered pricing based on your needs.

- Basic – $9 (£6.50) per month

- Standard – $19 (£14) per month

- Professional – $29 (£21.50) per month

Or, you can pay yearly to get 2 months off the total price.

Try out Zoho Books Online Accounting Software here:

2. What is Cloud Based Accounting Software?

Historically, accounting software would be a thing of nightmares for most business owners. It was offline, complicated to learn and the user experience was like a series of spreadsheets.

Not anymore. The best cloud based accounting software platforms are slick, easy to use and extremely powerful.

If you have ever used an online app or platform (like G Suite or Microsoft) you’ll find cloud accounting very similar. After logging in, you access different functionality components and pages via a toolbar and navigation links.

User experience is at the forefront of accounting platforms because it’s so important for sustainable and proper use of the software. Obviously, a lack of either will greatly increase the chances of losing a customer.

All of this is summed up in an all important dashboard which provides a real-time overview of the most important accounting information. Basically, the financial health of your business is summarised on a front page.

Cloud based accounting software for small business is critically important because it underpins future success. In reality, this means picking the right one and getting it set up properly from the outset.

3. What are the main features of accounting software?

If you’re going to succeed, you need to understand the software that enables your business.

Here are the core features of cloud accounting software:

Bank Feed

This connects the software to your business bank account which then allows it to automatically import the transactions for a given period. All incoming and outgoing financial activity is catalogued in real-time and then can be reconciled against invoices and bills.

Dashboard

This provides an overview of your account activity and key metrics such as cash flow, profit and loss, account balances, expenses, accounts payable and receivable, and sales. Usually, these can be customized too.

Online Invoicing

Invoices are generated digitally then emailed with payment options enclosed. The best cloud based accounting software allows for online payments which means you get your money faster.

Recurring Invoices

This is when the system automatically generates and sends invoices on a specific and repeatable (such as the fifth day of every month). It’s great for recurring charges like subscriptions or retained fees. Nowadays, the majority of online accounting software has this feature on all plans, but double check if its important to your endeavours.

Bank Reconciliation

Bank reconciliation allows you to match transactions to invoices or bills. It’s easy, convenient and really useful to any business owner.

The best applications suggest potential matches as you reconcile your accounts and a few include a reconciliation tool on their mobile apps.

Financial Reporting

As the name suggests, this allows you to review and analyse different financial aspects of your business. From profit and loss to the balance sheet, you can generate reports with a few clicks, and the best accounting software allows for customised and specialist insights.

Mobile Apps

These differ in capability from simple expense tracking (and receipt scanning) to the full web-based feature set.

Integrations

Connecting other tools to your accounting software means you can add additional functionality that’s important to the running of your business. This could be CRM, payroll, compliance, data capture, productivity apps and even HR software.

This is all about streamlined workflows for super convenient and effective use of time. For this reason, it’s a good idea to review the software you use and contrast it against your preferred accounting software.

Inventory Management

Any business selling tangible products will benefit from being able to manage the inventory from within the accounting software. Typically, this kind of feature is included in the higher tiered plans on most acccounting platforms.

Project-Based Billing

Project based work requires accounting software that can track tasks, time taken and budgets. The software typically allows you to invoice customers for chargeable time alongside a separate bill for any project expenses.

4. Other FAQs

Which small business accounting software is best?

QuickBooks Online is the best cloud based accounting software because it offers the most value to both startups and larger businesses.

It has every function most businesses will ever need and can be tuned for specific sectors. But the best bit… it’s backed up by industry-leading customer support for proper peace of mind.

What do you need from your accounting software?

There is no simple answer to this question, unfortunately.

At the most basic level, accounting software should accurately track the money moving in and out of your business. To do this properly, it should connect to your business bank account to access transaction data in near real-time.

In addition to the basics, you might want project management accounting tools for chargeable time-based services. Alternatively, inventory management might make sense because you sell tangible products and want your accounts to link directly with stock.

Another worthy consideration is how well a given accounting solution integrates with other business applications you use. It could be for customer relationship management, email marketing software, compliance or a Point Of Sale (POS) system.

To work out what’s required, simply draw up a list of every application and tool you use, then contrast it against your business activities. Then, sleep on it (more than once) to make sure you’ve not forgotten anything.

Alternatively, you could use a service like QuickBooks ‘live bookkeeping’ which sees one of their experts take over the set up process.

What’s the difference between bookkeeping and accounting software?

Nothing – both terms are used interchangeably.

All the best online accounting software for small businesses have bookkeeping capabilities built-in. They allow you to record debit and credit transactions as well as run basic reports.

Of course, as this review illustrates with much detail these platforms do alot more than that, and can handle most accounting needs.

Should your accounting software also act as an invoice generator?

Yes. We live in the digital age when invoices are emailed directly for payment. Accounting software that can’t do this for you is out of date and just makes more work from what is a very basic task nowadays.